Open House Saturday April 6th, 1:00-3:00pm

Choose the right time of year to look for a new home.

January is the best time to make an offer on a home. Not many buyers want to brave the cold to shop for a home, so prices are the lowest. Properties also take longer to sell. This means sellers are more likely to accept a lower offer.

Please go to the link below and see the quick search links for detached homes under 1.3K, or attached homes under 800K in White Rock South Surrey Neighbourhoods. Or feel free to create your own customized search!

YOU can also search Sold listings. So you know what homes have been selling for in the neighborhoods you are most interested in.

https://whiterockviews.ca/home-buyer-search.html

CMHC Incentive - Qualifying first time home Buyers ONLY Need 5% Down.

So if you purchase a home for $450,000, you will only need to put down $22,500. Purchase for $500,000 = $25,000 down, etc...

First Home Savings Account - Qualifing First time home Buyers can contribute up to $8,000 yearly to a maximum of $40,000 towards a down payment. Contributions are tax deductible.

HBP ( Home Buyers' Plan) Qualifying Home Buyers can withdraw up to $35,000 (couples up to $70,000) from their RRSP's for a down payment. Must repay within 15 years. Eligibility to use the program a second time...

Reach out. I woul love to help you make the right move, towards home ownership. You can do it!

CMHC Incentive - Qualifying first time home Buyers ONLY Need 5% Down.

So if you purchase a home for $450,000, you will only need to put down $22,500. Purchase for $500,000 = $25,000 down, etc...

First Home Savings Account - Qualifing First time home Buyers can contribute up to $8,000 yearly to a maximum of $40,000 towards a down payment. Contributions are tax deductible.

HBP ( Home Buyers' Plan) Qualifying Home Buyers can withdraw up to $35,000 (couples up to $70,000) from their RRSP's for a down payment. Must repay within 15 years. Eligibility to use the program a second time...

Reach out. I woul love to help you make the right move, towards home ownership. You can do it!

I am very passionate about helping my clients get into the Real Estate Market. Such a great investment for their future. Please contact me for a free consultation, and I will give you the resources to get you on the right path. Namaste.

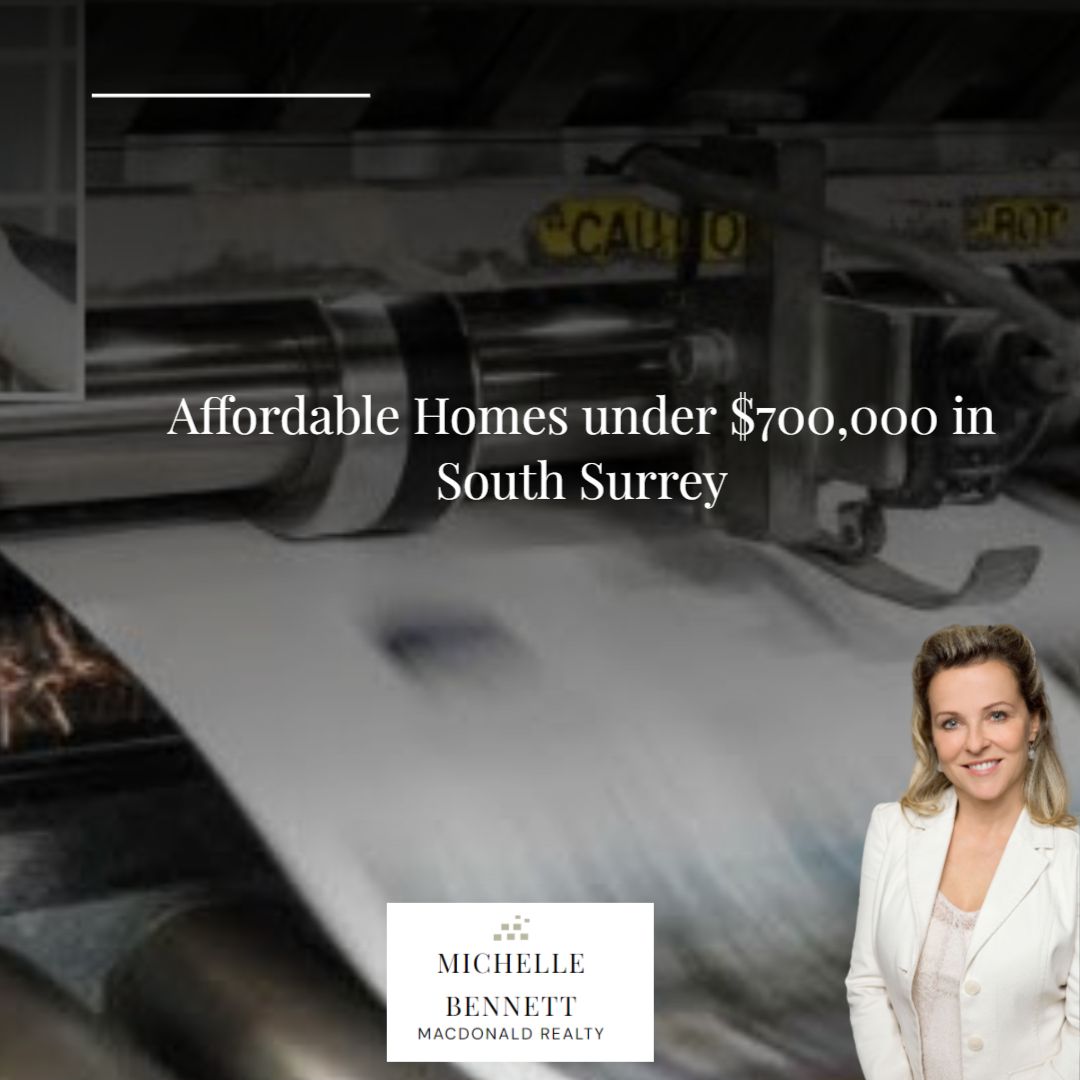

The latest housing assessment figures in British Columbia show residential property markets softening across the province, but analysts say it may not bode well for affordability in the coming year.

The concerns stem largely from the potential drop in interest rates later this year, which may spur homebuying activity while housing supply remains limited, driving up prices.

Contact me for a customized analysis. I look forward to hearing from you!

Why Purchase a home with a mortgage helper?

Renting out part of your home offers significant financial gains, and is encouraged by the Canada Mortgage and Housing Corporation (CMHC), for being an effective contributor to affordable rental housing. For example, the Crown Corporation estimates secondary suites account for one fifth of all rental supply in Vancouver, a city with nearly zero (0.6%) rental vacancies.

“Not only are secondary suites a source of affordable rental housing, they can also provide the needed extra income to first-time buyers for whom that additional income makes housing affordable in high-cost areas,” the CMHC states on its website. In September 2015, it also passed new rules to make it easier for landlord homeowners to qualify for loans and mortgages – 100% of gross rental income can now be included as part of their debt-servicing ratio.

While that’s a big plus for buyers who are looking for the additional help qualifying, the CMHC points out that income suites are also a great option for retirees who may not wish to downsize & leave their family homes. “For older households who no longer need a larger house, the addition of a suite can generate needed income and security, as well as allow them to continue to live in their neighbourhoods and age in place,” it states.

However, you’ll be sharing your home with other people, and that’s not for everyone. Be sure you're willing to tolerate things that go bump in the day and night. It is important to do your research on what you will need and what to expect as a landlord.

Please reach out for more information. I would love to be of assistance in helping you reach your real estate goals.

Choose the right time of year to look for a new home.

January is the best time to make an offer on a home. Not many buyers want to brave the cold to shop for a home, so prices are the lowest. Properties also take longer to sell. This means sellers are more likely to accept a lower offer.

Please go to the link below and see the quick search links for detached homes under 1.3K, or attached homes under 800K in White Rock South Surrey Neighbourhoods. Or feel free to create your own customized search!

https://whiterockviews.ca/home-buyer-search.html

I look forward to being of assistance.

View affordable homes available right now in South Surrey/ White Rock Communities.

Sure, you could drop $5-10 million on an oceanfront dream home. But you can also get into a Condo for less than $500,000. Providing plenty of buying opportunities for those just starting to work their way up the property ladder.

Check out the link below and let me know if you have any questions.

https://whiterockviews.ca/home-buyer-search.html